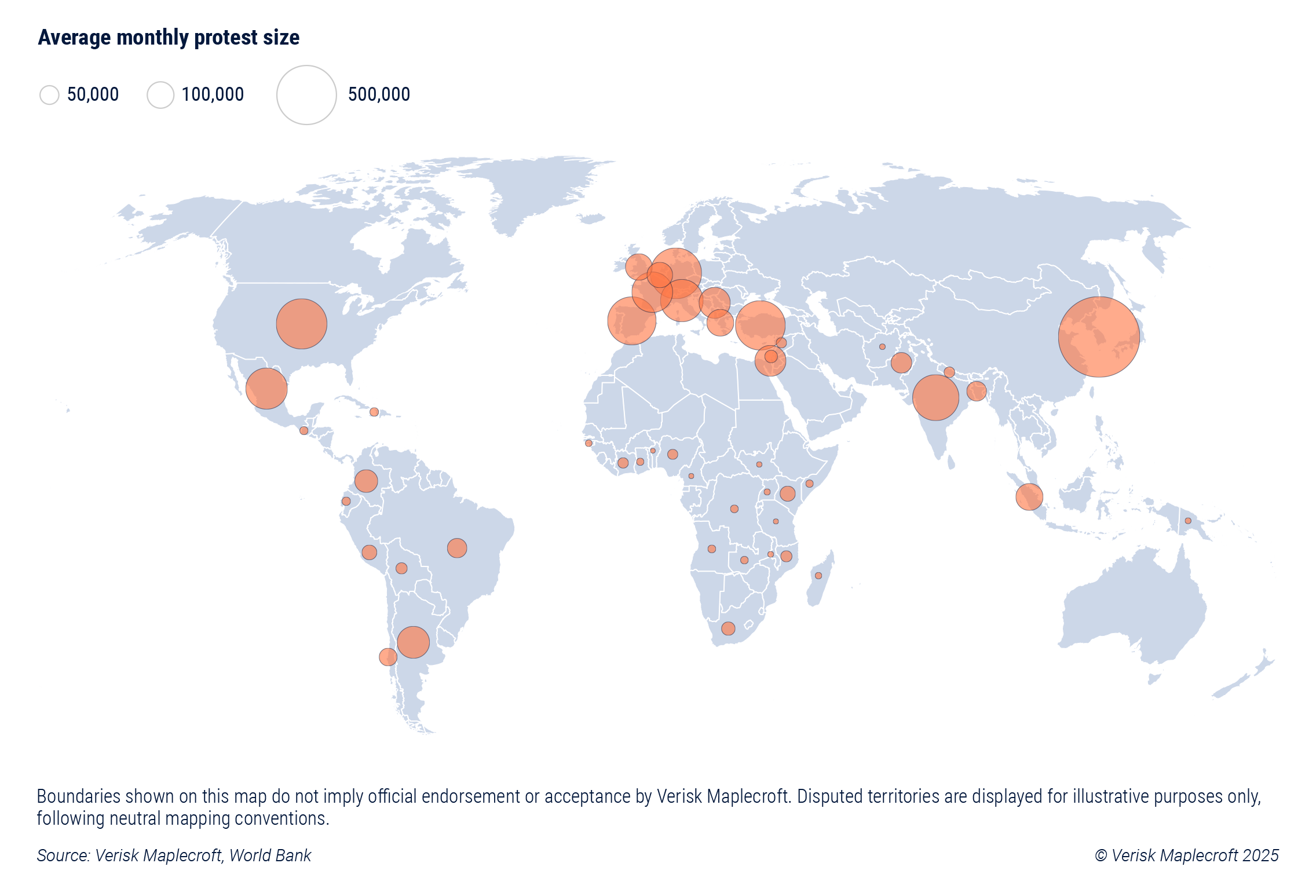

Protest activity globally has increased over the last two years, according to our civil unrest data, while commercial property is being targeted more often during protests, causing hundreds of millions of dollars in damages and business interruption. In parallel, rising political polarisation, mounting pressure on public finances and social media will combine to amplify popular discontent. The key message: governments, business and insurers should expect frequent disruptive protests and riots in 2026.

Our Civil Unrest Index shows that seven of the world’s biggest economies are among the countries facing the most disruption over the next 12 months. Europe is home to half of the 10 highest-risk countries, including Germany, France, Spain, Italy and the United Kingdom. Ranked 3rd highest risk globally and having recorded the sharpest increase in protest size over the last 12 months, the US is another potential flashpoint. Brazil, Mexico, India and Myanmar make up the remaining countries in the top 10, underscoring the broad set of countries impacted by civil unrest.

With businesses facing more disruption and insurers adjusting to more frequent high-impact events, the need to assess civil unrest more rigorously has never been greater. To stay resilient, insurers and companies must factor in asset locations, how visible or symbolic they are, alongside the underlying risk of unrest in a given location to make sure they have full visibility of their exposure.

All regions globally exposed to rising civil unrest risk

The first nine months of 2025 passed without events on a similar scale to those seen in Chile in 2019, the US in 2020, South Africa in 2021, France in 2023, and New Caledonia in 2024, which all saw over USD1 billion in insured losses. But the risk of another wave of damaging unrest is rising.

Our civil unrest data shows that based on the frequency and intensity of protests over the last 12 months, civil unrest globally is expected to be more disruptive in 2026 than in 2025. The underlying factors creating the conditions for unrest include economic volatility, income inequality, the conduct of security forces, and corruption.

In total, 53 countries recorded an increase in attacks against commercial property over the last year. The cost of the damages from August’s widespread rioting in Indonesia is expected to top USD50 million in insured losses, while the country’s stock market, the Jakarta Composite, recorded a 7% drop during the height of the protests, hitting manufacturing and technology companies most severely. In Nepal, insured losses from protests are expected to be on par with those caused by the devastating 2015 earthquake, which exceeded USD200 million.

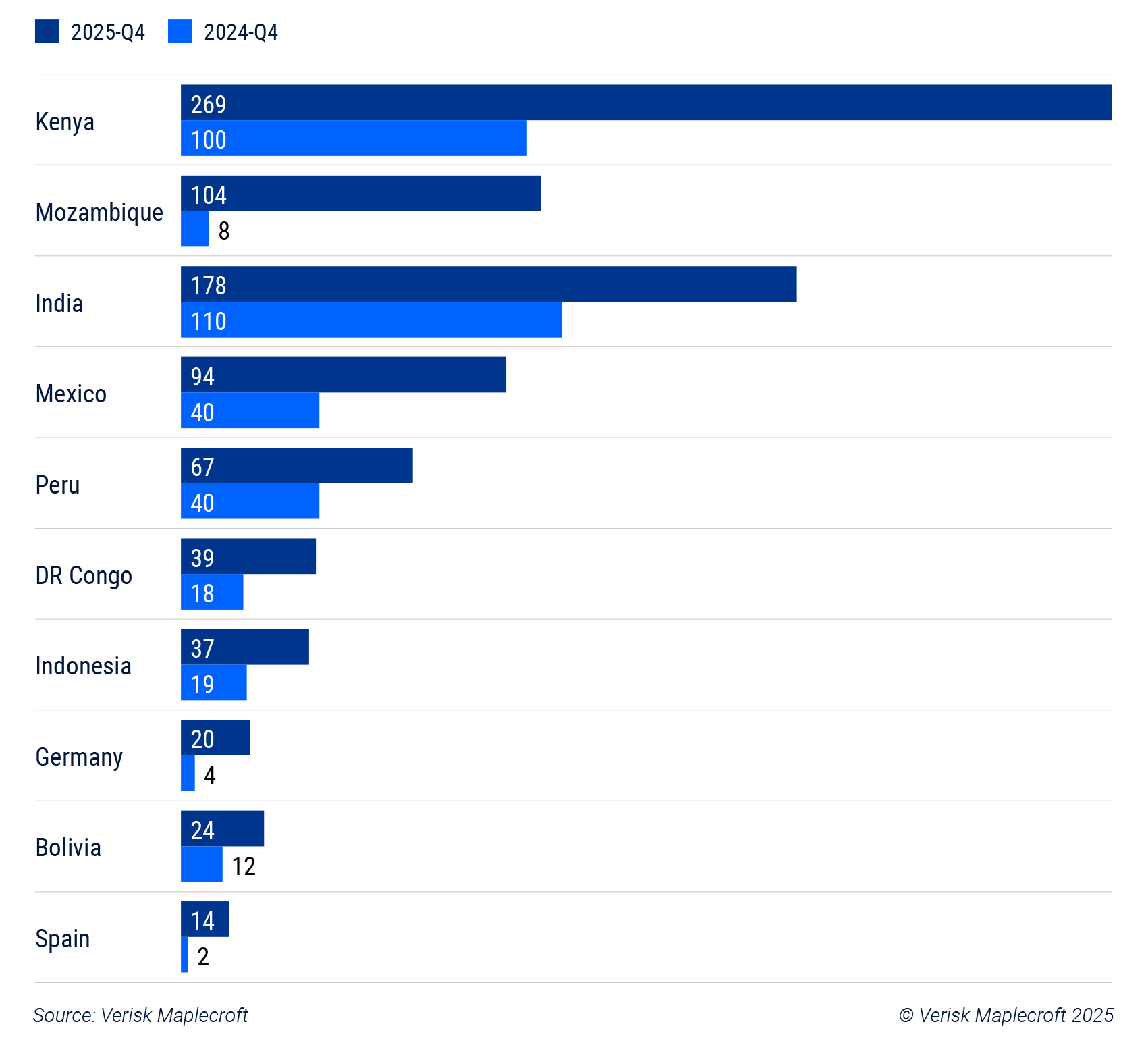

Kenya, Mozambique, India, Mexico, and Peru saw the biggest increase in attacks against commercial property over the last year, as shown in Figure 2. The 10 countries with the biggest increase feature a mix of major developed economies, such as Germany and Spain, large emerging economies like India and Mexico, and smaller emerging markets dependent on exports of natural resources, like DR Congo, Mozambique and Peru.

The triggers for major protests during 2025 vary, but there are common themes. Our civil unrest data shows that corruption has long been a driver of civil unrest risk in Indonesia, Nepal and the Philippines and popular anger over political graft has featured centrally in the recent wave of unrest in South and Southeast Asia. The conduct of law enforcement has been another common theme, with protests in Indonesia, Nepal and Angola all escalating in response to the use of lethal force by security forces.

Seeds of unrest take root in Europe and US

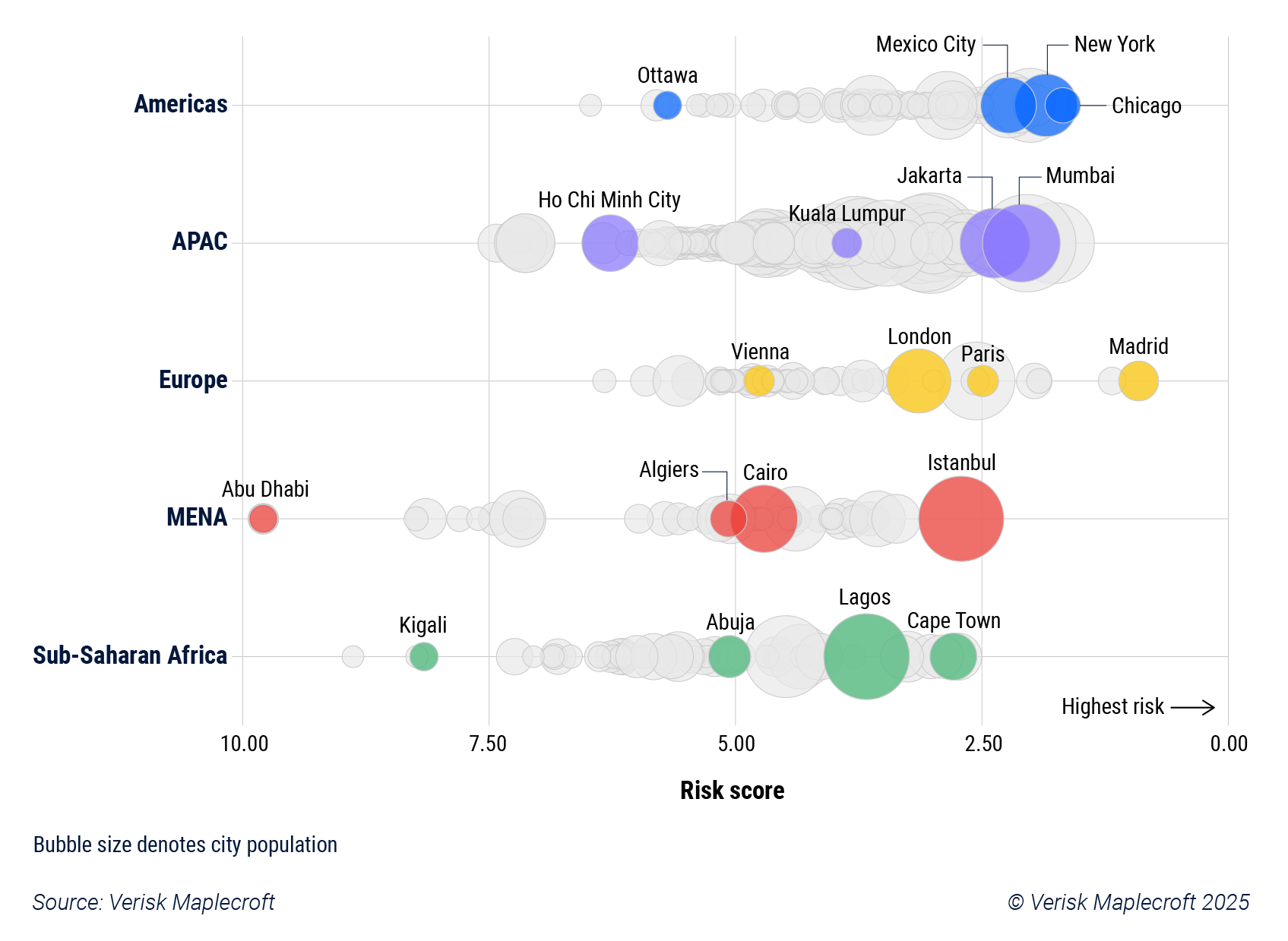

Europe and the Americas are the only regions without any major cities on the lower end of the risk spectrum (see Figure 3). Our civil unrest data shows that protests in Europe are not just increasing in size but also causing damage to private property more frequently in many countries and cities. Making matters worse, fiscal pressure is mounting, placing governments in a precarious position as they struggle to manage rising discontent. Increased defence spending, global trade volatility, and concerns over Europe’s competitiveness in the global economy are straining government finances across the region. The concern for a growing number of European states is that mounting economic pressure will increase poverty and social inequality, both of which are drivers of civil unrest risk, according to our data.

The dilemma facing a growing number of leaders grappling with both economic headwinds and rising social unrest is starkest in France, where opposition to proposed public spending cuts sparked large-scale protests, with an estimated 195,000 protestors taking to the streets at the start of October.

Rising political polarisation in Europe also threatens to stoke public discontent over migration. Protests exceeding 100,000 people, where calls for tighter immigration controls were a central theme, have been held in both the UK and Germany. These protests were mostly peaceful, but protests over immigration elsewhere in Europe, including in Spain and the Netherlands, have turned violent. The combination of these issues is creating a volatile mix for Europe, especially within its largest economies, where the outlook for unrest is bleak.

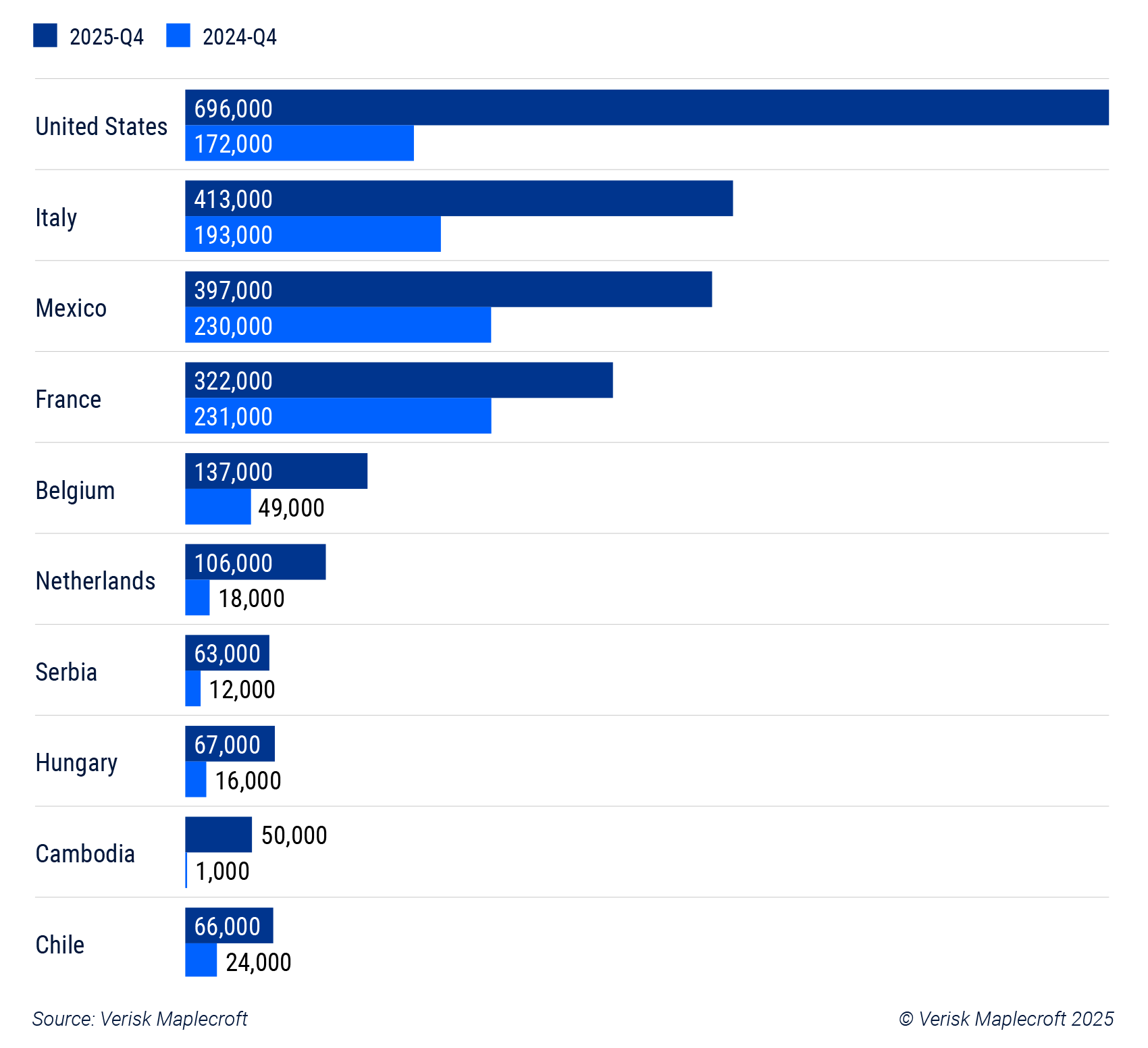

On the other side of the Atlantic, the US has recorded the largest increase in monthly protest size over the last 12 months, from an average of 172,000 people in 2024-Q4 to 696,000 in 2025-Q4. As in Europe, rising levels of political division are a growing concern. Polling has consistently pointed towards accelerating polarisation over the last decade, and in combination with rising protest activity, deepening political divides increase the risk of escalation into more damaging unrest over the next 12 months.

As we cautioned in September 2024, the underlying risk of civil unrest in the US was unlikely to ease after the presidential election, as our research shows that elections historically have not been strong predictors of damaging civil unrest.

Increase in share of protests that turn violent would have wide-reaching implications

Our research shows that 90% of protests are peaceful, with only 10% turning violent – including clashes between protestors and security forces or between opposing groups of protestors. The share of protests that directly damage private property through vandalism and looting is even lower, accounting for fewer than 1% of all protests.

However, with political polarisation rising, and the increasing ability of social media to intensify protests, the likelihood of major episodes of unrest across world over the next 12 months is rising, imposing additional costs for business in an already volatile economic environment. For companies impacted by this disruption, using data and analysis to understand the underlying risk of protests in individual countries and cities will be crucial to help business and insurers distinguish between temporary flashpoints and more structural long-term civil unrest risks.