The majority of the world’s emerging market (EM) supply chain hubs, including the BRICS nations of Brazil, China and India, are in a strong position to withstand the tariff regimes that have buffeted the world in 2025, according to our data. The analysis benchmarks the resilience of 20 key emerging markets to trade volatility and geopolitics, and has been developed to help companies navigate a new and shifting trade environment.

Trade and economic nationalism have challenged businesses over the past decade, increasing uncertainty and costs. What’s different now is how geopolitics and trade are combining to heap pressure on major emerging markets, as the US seeks to reduce reliance on its economic links with China, while scrutinising the origin of goods coming from third-party markets.

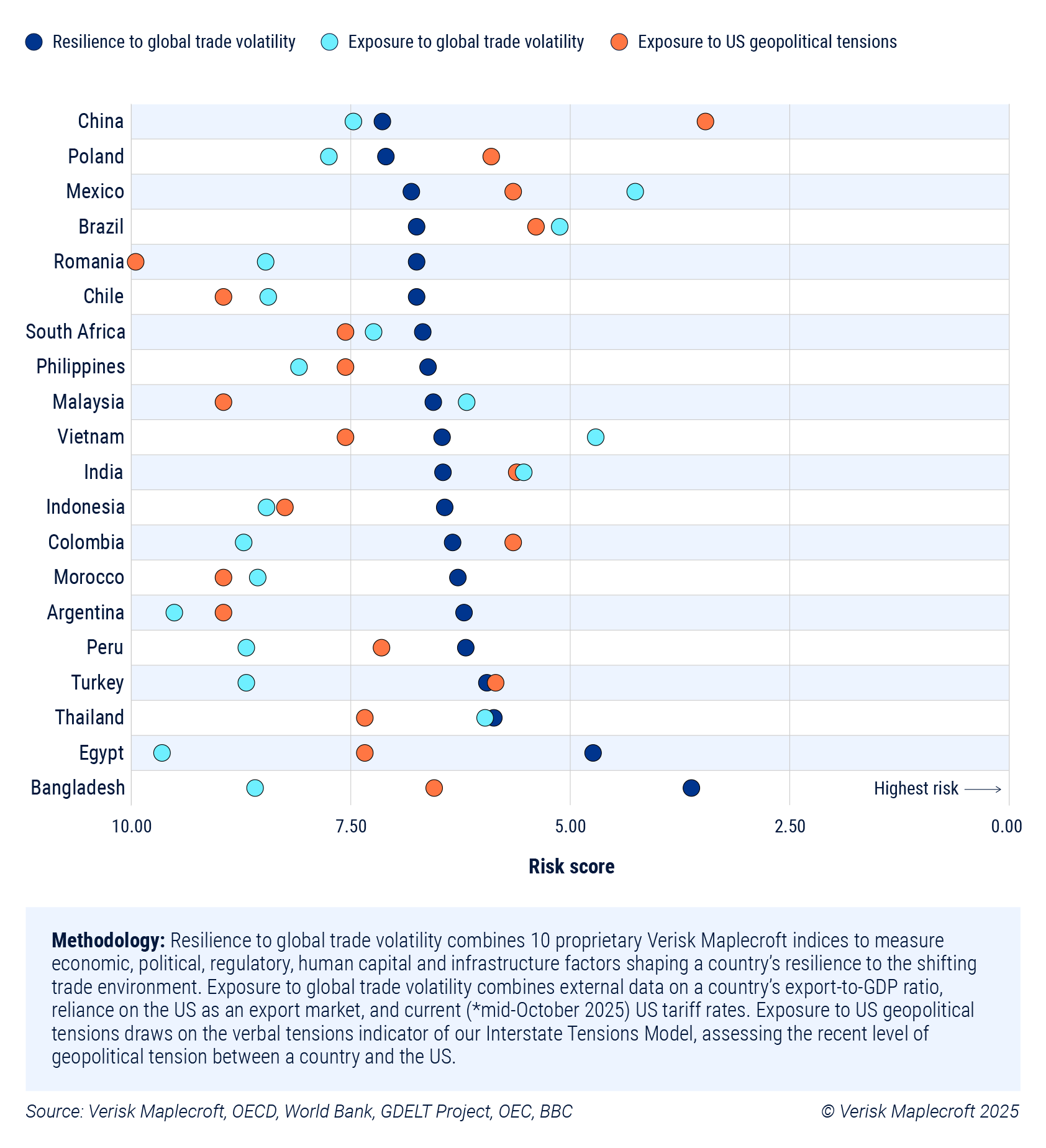

While China is ranked as the 8th most exposed of the 20 emerging markets to trade risk, based on tariff levels and percentage of exports to the US, our data shows that it is the most resilient to trade volatility. Its high ranking for reserve adequacy, low levels of foreign debt and strong performance on human capital and transport infrastructure reinforce its position as the world’s key manufacturing hub, making it difficult to dislodge from supply chains even as near-shoring accelerates.

Mexico and Vietnam are ranked 3rd and 10th for resilience but are coming under pressure owing to China linkages in their manufacturing supply chains. Significantly, the data shows how companies can identify the countries that are currently most resilient and those which may need to reform to maintain competitive advantage. Over the next five years, manufacturing companies can no longer rely on the old playbook of optimising for cost, efficiency, and demand alone. Instead, they must rethink three things simultaneously: how to maximise supply chains to access the US market while avoiding penalties; how to diversify export destinations without losing share in large, resilient economies; and which emerging markets offer the best mix of incentives and low geopolitical exposure.

China, Brazil, India offer opportunities beyond tariff resilience

To assess the investment potential of emerging markets and how well they can withstand trade volatility, we used external metrics on US trade and tariffs, alongside our measure of geopolitical alignment, to identify their exposure. For resilience factors, we have drawn on our Country Risk Data, focused on key structural issues such as economic strength, political stability, the regulatory environment, human capital and infrastructure. The data provides a unique view of each country’s ability to absorb tariff shocks and maintain attractiveness for manufacturing companies.

As Figure 1 illustrates, despite being the primary targets of the US tariff regime, the major BRICS economies – China, India and Brazil – along with most other emerging markets, currently demonstrate high levels of resilience to these measures and are well placed to weather existing trade volatility.

The BRICS economies (excluding sanctioned Russia) benefit from strong reserves, manageable debt, and large domestic markets, which provide an economic buffer that smaller economies lack. Facing tariff rates of around 50%, Brazil and India are ranked 4th and 11th respectively for resilience on our assessment of the 20 emerging markets.

India benefits from a high level of economic resilience overall, but has a lower score on our regulation index, identifying an area where it needs to reform in order to continue attracting investment. Its surging domestic capital markets highlight rising financial independence and a growing capacity to finance tech and supply chain expansion without relying on volatile foreign inflows. India sends around 20% of its exports to the US, but its relatively low export-to-GDP ratio – reflecting its large domestic market – is a buffer against trade volatility.

Despite Brazil’s high headline tariff rate, many key export sectors were excluded, reducing the overall impact. The country has also capitalised on heavy international demand for its agribusiness sector by boosting exports to other markets. South Africa faces comparatively lower headline tariffs (around 30%), but its weaker infrastructure, particularly around electricity supply, and high levels of social unrest undermine its overall performance.

Mexico and Vietnam stand out as the most exposed due to their deep US trade dependence. Yet our data shows that their progressive economic policies, improving infrastructure, and high levels of political stability keep them among the more resilient mid-tier economies. They will remain attractive in the near to medium term, given lower tariffs compared to China’s potential 145% rate. They do, however, face rising scrutiny from Washington as it moves to curb tariff workarounds through Chinese-linked supply chains.

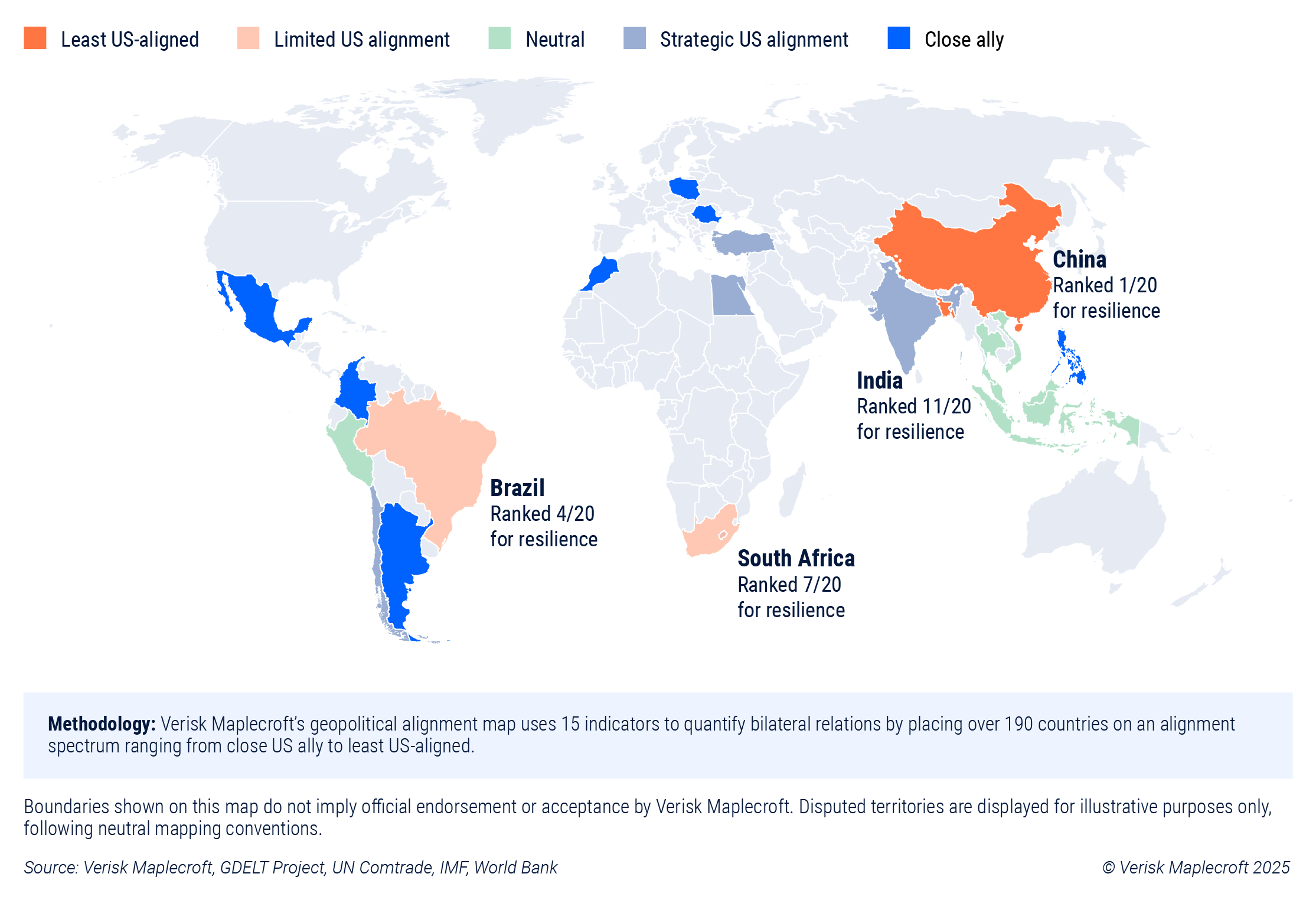

Geopolitics will define the emergence of new trade blocs and opportunities

Ongoing tariff negotiations and unexpected tariff announcements will continue to inject uncertainty into business decision-making over the medium term. Geopolitical alignment with the US is no guarantee of a better deal, as the upcoming review of the US-Mexico-Canada trade agreement (USMCA) indicates.

On the contrary, we assess that tariff pressures will encourage mid-tier economies to further diversify links beyond the US, with emerging trade blocs coalescing around the major economies of India, China and Brazil.

Our geopolitical alignment map (see Figure 2) shows India as the only US-leaning BRICS member, although recent tariffs and diplomatic tensions are nudging it closer to China and Russia in areas such as technology, energy, and finance. India has the third-highest risk score for geopolitical tensions with the US out of the 20 emerging markets, underlining recent exchanges over Russian oil. Meanwhile, Brazil and South Africa are maintaining greater strategic distance from Washington, building links with other trade partners. Brazil’s push in 2025 for acceleration of the long-awaited EU-Mercosur trade deal is a key signpost for how economies can boost resilience by forging larger trade blocs.

Geopolitical balancing act will dictate business strategy

Vietnam and Mexico have benefited from increased China-linked investment over the last decade as successive US administrations pushed companies to diversify their supply chains away from China. However, the US is now increasing scrutiny of China-linked manufacturing hubs. The USMCA review will challenge Asian firms using Mexico, alongside Canada, as production gateways to the US for Chinese-origin goods. As a result, Vietnam and Mexico, along with similar economies such as Malaysia and Indonesia, now face higher tariffs and deeper compliance risk.

As US-China trade tensions deepen, these mid-tier emerging economies are likely to pursue a strategy of strengthening ties with the world’s two main geopolitical powers while avoiding overdependence on either. Many will present themselves as constructive partners to Washington, signalling compliance with its evolving trade stance, even as they expand links with alternative markets to hedge risk. This dual-track approach will open new avenues for global firms, as mid-tier economies cluster around the BRICS and drive fresh trade and investment flows across Asia, Latin America, and parts of Europe. Identifying where the market potential lies will be central to success as the new trade environment coalesces around these emerging geopolitical groupings.