In recent years, geopolitical risk has seeped into every part of the international system and the operating environment for business. US-China rivalry, conflicts in Ukraine and the Middle East, a more emboldened Russia testing the flank of NATO, and accelerating climate disruption are combining to reshape the world as we know it. For global business, the challenge is twofold: mitigate today’s volatility, and set the groundwork to build resilience for what might come next.

Predicting the future is no easy feat though. No one has a crystal ball and nothing is certain. However, by examining how political, economic, security, and social dynamics between nations and regions could unfold over time, geopolitical scenario analysis can help us understand the different pathways that might emerge.

Drawing on our Country Risk Data, predictive analytics and the expertise of our senior analysts, we’ve mapped out three plausible geopolitical futures up to 2030:

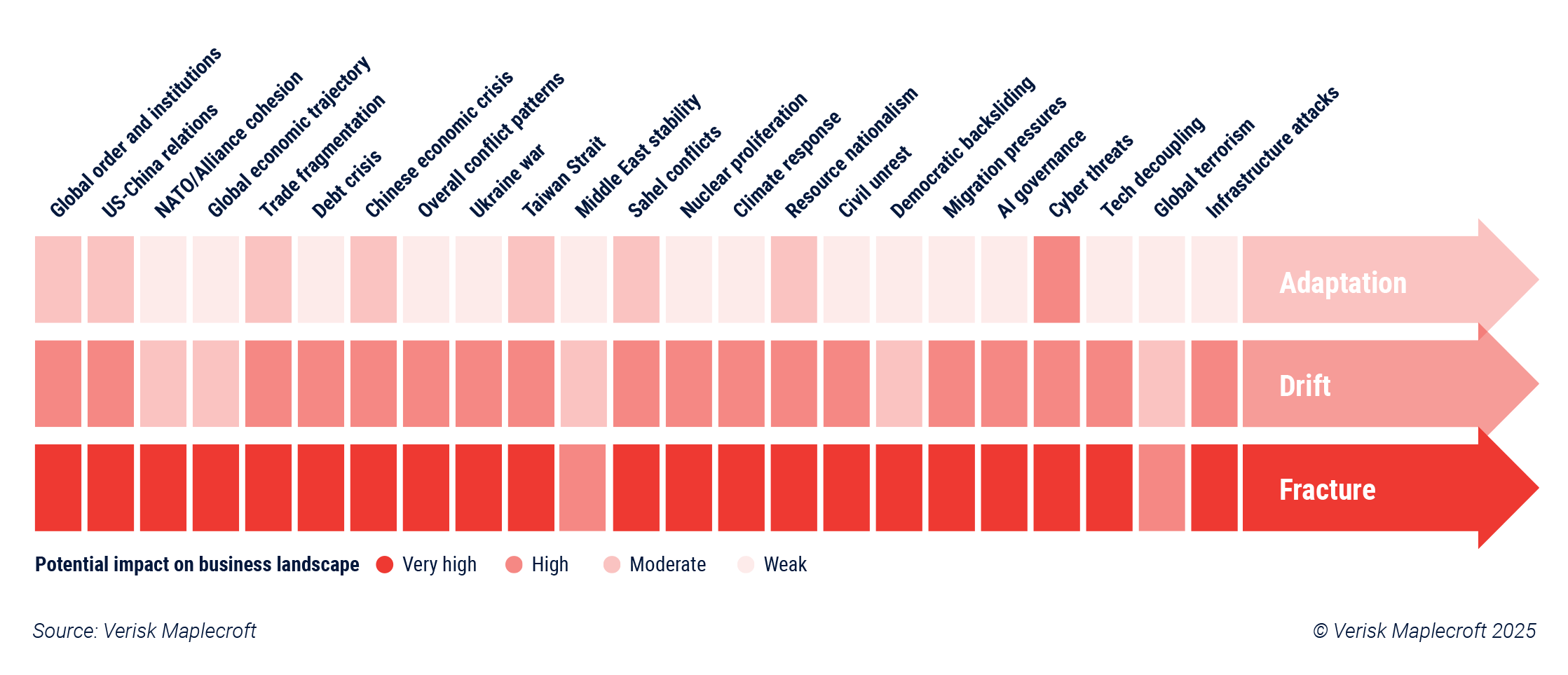

- Drift: Our most likely scenario sees the continuation of the current risk trajectory, where geopolitical competition, shifting alliances and trade volatility drive persistent uncertainty for global business. Here, companies face rising costs from ongoing trade reconfiguration, climate disasters, and cyber disruptions, while economic instability weighs on growth, social dynamics and investment. Conflict remains widespread and the use of deniable grey zone tactics increases across different theatres.

- Fracture: The worst-case scenario, where a breakdown of the multilateral system fuels greater political violence, terrorism, and conflict. In this version of the world, companies must navigate severe regulatory misalignment and the costly restructuring of supply chains, operations and market strategies. In some cases, this may mean splitting or breaking up operations across regions to insulate themselves from a more fragmented geopolitical, economic and regulatory environment or even withdrawal from markets.

- Adaptation: Our best-case (and least likely) scenario provides a path where the stabilisation of the global system opens new growth opportunities, but stricter climate and regulatory regimes raise compliance costs and demand strategic investment in resilience and operational transformation.

While the pathways between our three scenarios differ, they share common, and concerning, characteristics that will fundamentally impact the global business environment:

- Intensifying great power competition

- Weakening global institutions

- Entrenched economic nationalism

- Mounting climate and societal shocks

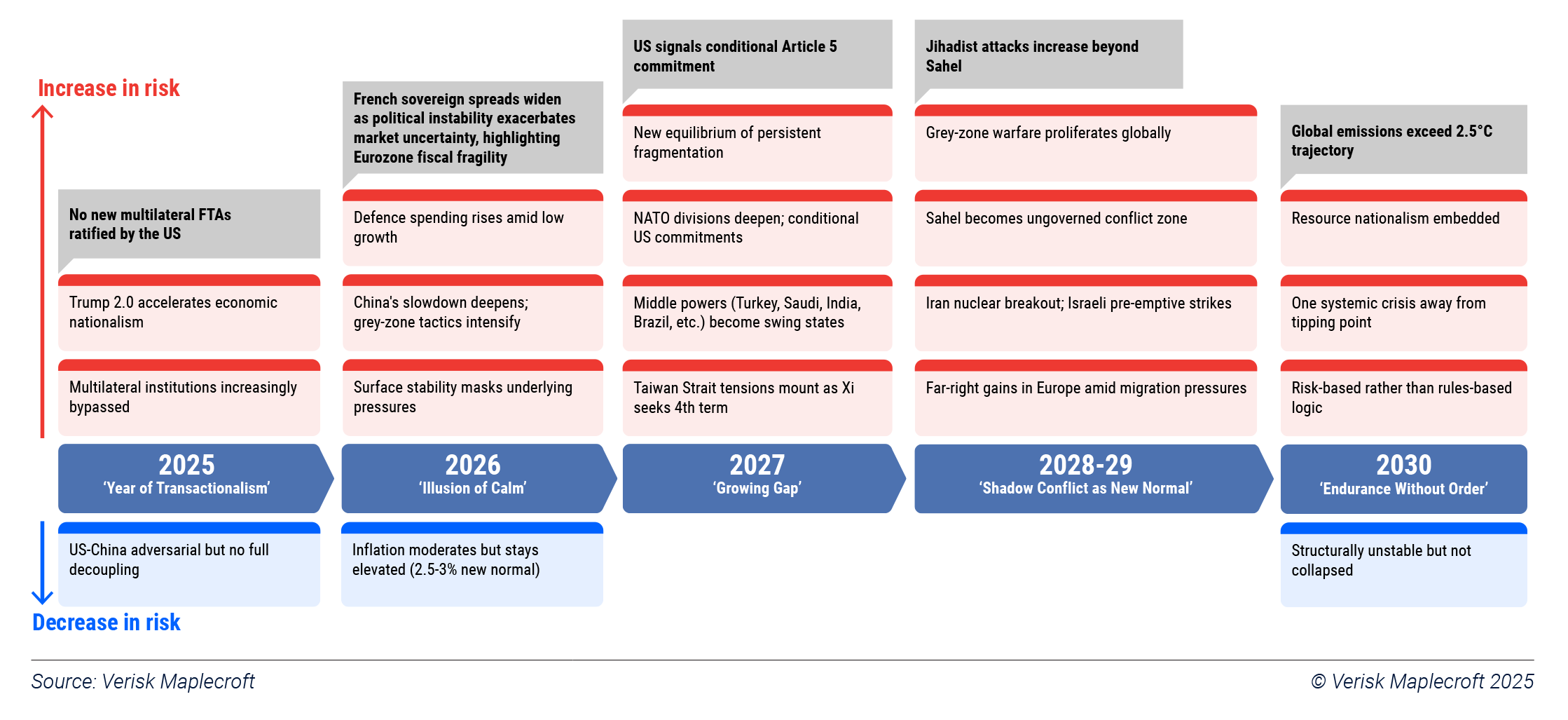

Drift, Fracture and Adaptation are not, however, sealed boxes. One trajectory can evolve into another. Signposts, such as further tariff escalation, military crises, or renewed institutional cooperation will be critical to watch. For business, the imperative is not if risk will rise, but where and how it will manifest and with what implications. Using accurate, independent and defendable Country Risk Data to look for both red and green flags is one way to stay ahead.

As it stands now, geopolitical competition between major powers is entrenched, with risks rising across both emerging and developed economies, as highlighted throughout this year’s Political Risk Outlook. The US is pursuing economic nationalism, while China extends its influence through Belt and Road projects, infrastructure deals, and expanding South-South trade. At the same time, conflict and sanctions are spreading, creating ongoing uncertainty for global business. Against this backdrop, our scenarios suggest that volatility and risk will remain the norm through to the end of the decade. To help you see how this might play out, in this analysis we focus on our most likely scenario, Drift.

Drift: Peace at Home, Storm Abroad

The international system continues to erode

As attempts to revive multilateralism falter, the old trade architecture will continue to erode. A pattern that has been building for years has now accelerated, with tariffs on track to become a permanent feature of international trade. In tandem, domestic industrial policy across countries and blocs will become increasingly weaponised as governments across the globe attempt to protect their own economic and geopolitical interests.

In this context, Drift, our most likely pathway up to 2030, will see the world defined by the ongoing, gradual disintegration of the international order. Institutions like the UN and WTO persist but lose relevance. Bilateral deals, brokered on personality or ideological affinity, take their place, creating a patchwork of rules that inject complexity into the international business environment. Governments prioritise domestic stability, often at the expense of global coordination, which amplifies political and regulatory uncertainty across all sectors.

As Washington distances itself from the global climate debate, Beijing will expand its influence. But this fractured landscape means that, overall, climate ambition will weaken further, leaving a future of higher catastrophe losses and insurance claims.

Despite a change in administration in 2028, we expect the US to maintain the current geopolitical trajectory. This is because the underlying forces driving competition with China – including strategic rivalry, maintaining technological supremacy, and concerns over supply chain security – are firmly established, as is selective economic nationalism.

A new administration in Washington may moderate rhetoric or adjust tactical approaches, but the pattern will persist. Multilateral engagement will remain cautious, and large-scale international commitments on climate, defence and trade will be weighed against domestic political priorities. As a result, US competition with China and a fragmented global trade environment will remain defining features of the global order through the late 2020s.

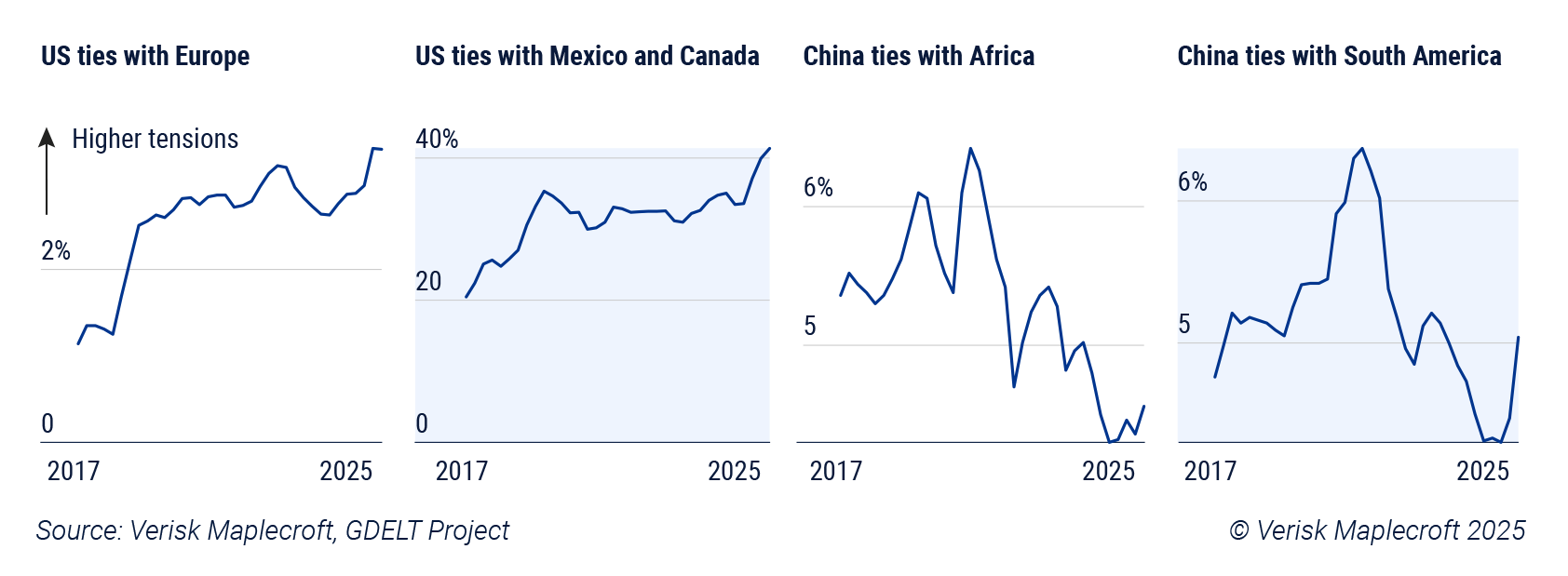

Trade volatility expands

Our Interstate Tensions Model shows that China’s bilateral relations with key emerging markets are improving, while those of the US are worsening – both with traditional allies and key EMs. In other words, Beijing is placing itself to gain ground as the US retreats from the international arena. As the space between superpowers widens – not only the US and China, but also Europe and Russia – middle powers will seek to exploit the situation, bargaining over arms, critical mineral resources, energy and trade, among other spheres. Trade ties and diplomatic collaboration between China and emerging markets will deepen, as the latter look to insulate themselves from tariffs.

This reordering of global influence will open new spaces for trade and pragmatic cooperation. Middle powers and large emerging markets continue hedging their bets, trying to play both sides and attract investments from the competing major powers and South-South peers. Opportunities for diversification in strategic sectors in these jurisdictions will support the emergence of logistics, processing and manufacturing hubs. Trade and capital flows persist, albeit with friction. Companies that can align strategies with these new emerging regional ecosystems will benefit from new growth corridors and supply resilience.

Workarounds to US-China restrictions will continue to emerge and neither side will manage to fully cut the other out. The relationship settles into a fractured co-existence. Open confrontation will not happen, but decoupling creeps forward in strategic sectors. Businesses will have to adjust by re-engineering their supply chains for resilience, and in some cases being forced to split operations and develop entirely separate strategies for different markets.

Globally, manufacturers and retailers are particularly exposed to this dynamic. They face rising operational costs and logistical challenges from diverging regulations and standards across different markets, including disputes between the EU and US on product specifications and environmental requirements. Fragile supply chains make businesses more exposed to changing rules, litigation, and consumer criticism. Tech companies confront conflicting rules on AI, semiconductors, and data governance, with compliance demands and regulation slowing down innovation.

From stalemates to sabotage, conflict persists

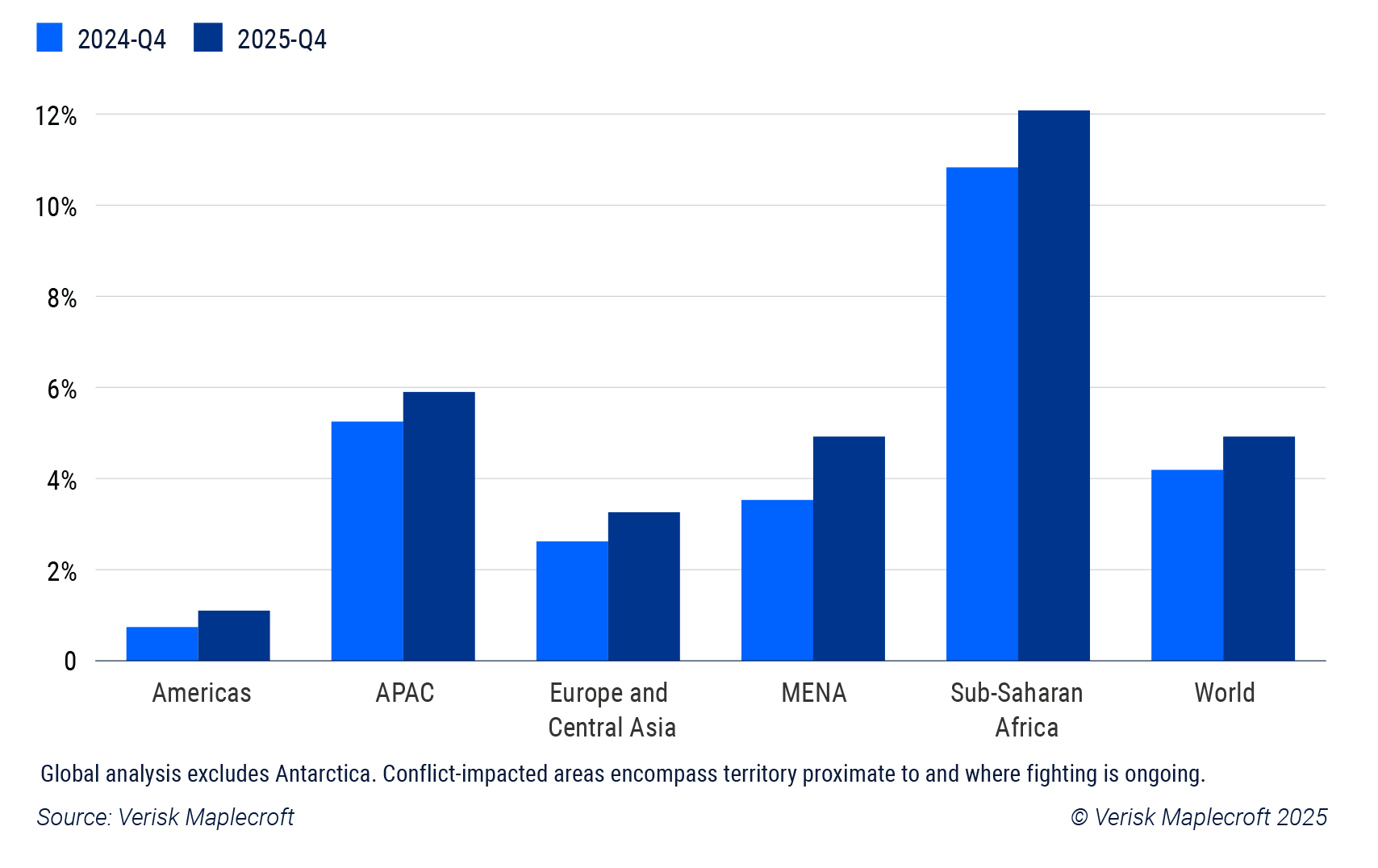

The intensification of conflict is a key trend in the Drift scenario. Since 2020, our data shows that the territory exposed to conflict has expanded to cover 5% of the world’s six permanently inhabited continents. We expect conflict to remain widespread but contained within existing regional hotspots. However, cyber sabotage and asymmetric, grey zone tactics, such as cable cutting, drone incursions and disinformation campaigns, will likely escalate, driving disruption for business and rising claims for insurance.

The Russia-Ukraine war drifts toward a chronic and costly stalemate, Sahel insurgencies expand and the Middle East maintains several areas of simmering tensions. The situation in Taiwan remains tense, but static. Toward 2030, pressures mount in the South China Sea, but are unlikely to spill over into open conflict.

We expect defence budgets to continue climbing worldwide. Europe faces one of the toughest balancing acts: its commitment to human rights and the green transition versus rearmament. As defence commitments surge, fiscal limits will be tested in more EU-member states, curtailing social spending which drives public discontent and rising unrest.

Across regions, governments are increasingly prioritising control over critical assets – especially in the minerals space – to safeguard national security and economic stability. This logic extends beyond energy geopolitics, signalling a global rise in resource nationalism. Yet, opportunities emerge for those able to adapt. As governments push to build resilience and localise production, resource-rich emerging markets could benefit from long-term industrial upgrading. This, in turn, would strengthen their strategic relevance in the global system and contain further fracturing as middle powers act as a bridge between competing blocs in an increasingly multipolar world.

Pivoting from Drift

Early signals of Adaptation or slipping into Fracture

While Drift is the pathway we see as most likely, it is not static. Incremental cooperation – such as G20 debt coordination, regional climate agreements, or cyber resilience compacts – could provide early signals of a shift towards our best-case scenario, Adaptation, offering firms opportunities to hedge risk and invest strategically. It is, however, our least likely future.

Conversely, given the fragility of the global system under Drift, geopolitical tensions, escalating conflicts, severe economic shocks or crossing climate tipping points could push the world toward our worst-case scenario, Fracture. This implies global institutions would weaken further, supply chains splinter, and protection gaps widen, creating acute operational and financial risks for firms. Early signs might include sharp trade decoupling, regional arms buildups, or abrupt resource nationalisation.

From risk to resilience

Across all three scenarios, systemic volatility will remain a defining condition of the late 2020s. The challenge for companies is to anticipate how risks manifest and adapt strategies accordingly.

Firms that embed foresight into strategy can mitigate losses, build resilience, and capture opportunities. Diversified supply chains, partnerships in resilient markets, and climate adaptation are already becoming competitive advantages.

Our Country Risk Data, scenario analysis and horizon scanning offer a unique perspective on the global risk environment and equip firms to monitor signposts, stress-test portfolios, and respond proactively. Political risk, strikes, riots and civil commotion, climate, and governance indices provide early warning of instability before it crystallises into material losses.

Decisions taken in the next five years – on investment, supply chains, and market alignment – will shape resilience into the 2030s. They will also determine which companies merely endure volatility, and which thrive within it.